define short term finance

This is the opposite of a more conventional long position where the investor will profit if the value of the asset rises. Purchasing from a receiver.

Sources Of Finance Long Term Finance Short Term Finance Ppt Download

Short term loans are called such because of how quickly the loan needs to be paid off.

. Long-term financing refers to business or personal loans that have Longer time span for repaying the loan more than a. In businesses it is also known as working capital financing. Occurring over or involving a relatively short period of time.

Something that is short-term has continued for less than a year or will continue for less than a year. In most cases it is used to finance all types of inventory accounts receivables etc. Article presents financial liquidity definitions relations among them and.

These objectives are usually smaller in scope and easier to predict and realize than long-term financial goals. Covering or involving a relatively short period of time. Short-term financial goals are objectives that organizations aim to achieve in a relatively short period of time often quarterly or annually.

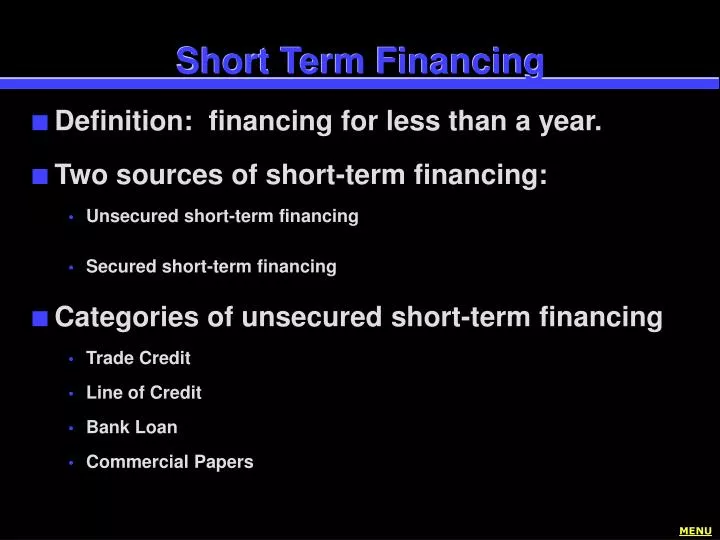

People who are doing things that make themselves better off in the short-run but worse off in the end are guilty of short-termism. Short term Finance options are bank overdraft short term loans line of credit etc. To finance the purchase of a property at auction.

Maturing after a relatively short period of time. Hierarchical Display of Short-term financing Finance Financing and investment FinancingFinance Financial institutions and credit Credit Short-term credit Meaning of Short-term financing Overview and more information about Short-term financing For a more comprehensive. With our definition from above in mind short-term finance differs from long-term finance in a few key ways.

The Fund is keeping maturities short because short-term investments are currently the highest-yielding segment of the market. Short-termism is what people suffer from if they focus excessively on short-term results at the expense of an individuals companys or countrys long-term interests. There are however no rigid rules about the term.

Short-term finance is typically used for working capital. This type of financing is normally needed because of the uneven flow of cash into the business the seasonal pattern of business etc. Perhaps the most obvious difference between the two types of financing long-term financing has longer.

It can help to finance working capital paying suppliers or even increase inventory. To fund the refurbishment of a property. Short-term finance refers to a businesss need to raise funds for a period not more than.

In many cases short-term loans are used to help a business build up inventory or raise capital when temporary deficiencies in funding occur. Short term loans are suitable not only for businesses but also for individuals who find themselves with a temporary sudden cash flow issue. Of relating to or constituting a financial operation or obligation based on a brief term and.

In finance being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. To raise short-term finance capital against equity in a property. It may sometimes exceed one year but still be called as short-term finance.

Short-term financing is designed to help borrowers finance for an immediate need without the burden of long-term financing though short-term loans typically feature higher interest rates than regular loans. Maximization of wealth of his owners is the basic financial aim in management of enterprise. Of or relating to a debt security in which a short period of time remains until the face value is paid to the.

In most cases it must be paid off within six months to a year at most 18 months. Short-term financial liquidity management contributes to realization this aim. Of or relating to a gain or loss on the value of an asset that has been held less than a specified period of time.

Long term financing is used for overall improvement of the business. Short-term finance refers to financing needs for a small period normally less than a year. Of a capital gain or loss derived from the sale or exchange of an asset held for less than a specified time as.

Fees Associated With Bridging Finance. Short or shorting refers to selling a security first and buying it back later with the anticipation that the price will drop and a profit can be made. Short-term financing refers to business or personal loans that have a shorter-than-average time span for repaying the loan typically one year or less.

Short term financing arises with an attempt to finance current assets. Characteristics of Short Term Loans. It could be used for purchasing or.

Periods varying from a few days to one year. To take advantage of an opportunity which requires a quick settlement Eg. Short term financing means the financing of business from short term sources which are for a period of less than one year and the same helps the company in generating cash for working of the business and for operating expenses which is usually for a smaller amount and it involves generating cash by online loans lines of credit invoice financing.

Short-term financing deals with raising of money required for a shorter periods ie.

Short Term Financing Definition Example Overview Of Top 5 Types

Sources Of Finance Powerpoint Slides

Sources Of Finance Bank Loans Tutor2u

Finance Term Paper Esl Term Paper Writers Website Australia University Homework Help

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

Managing Short Term Liabilities Financing Ppt Video Online Download

Ppt Short Term Financing Powerpoint Presentation Free Download Id 5853292

Short Term Finance Finance Long Term Financing Business Motivation

Chapter 3 Short Term Financing Pdf Factoring Finance Interest

0 Response to "define short term finance"

Post a Comment